boulder co sales tax rate 2020

Without the large audit. Boulder County CO Sales Tax Rate.

The Colorado state sales tax rate is currently.

. The 8635 sales tax rate in Louisville consists of 29 Colorado state sales tax 0985 Boulder County sales tax 365 Louisville tax and 11 Special tax. This is the total of state and county sales tax rates. You can print a 8635 sales tax.

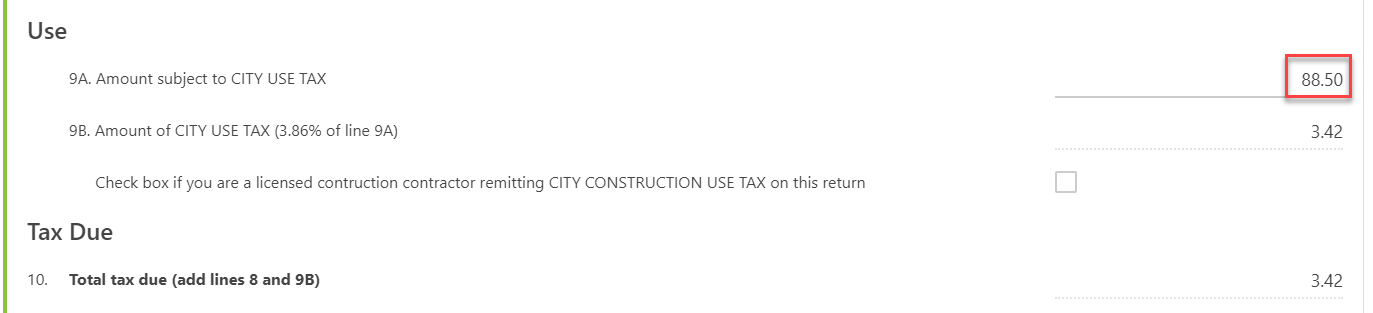

About City of Boulders Sales and Use Tax. Through May 2020 and is largely attributed to economic activity through the month of April 2020. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11. The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was 8845. The December 2020 total local sales tax rate was also 9000. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists.

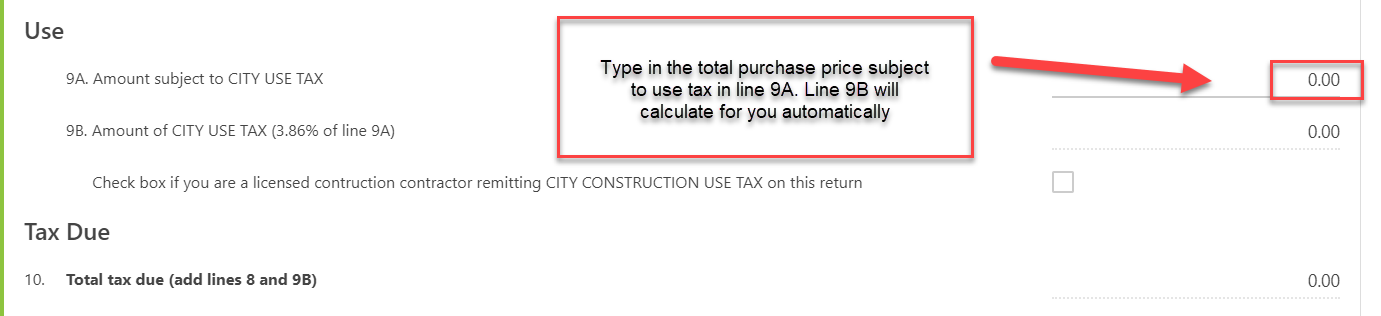

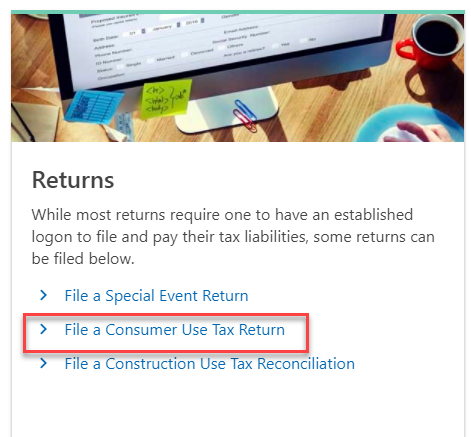

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and. The December 2020 total local sales tax rate was also 4985. The current total local sales tax rate in Boulder Creek CA is 9000.

Prior Year Sale Information. The ESD tax is on. March 2020 retail sales tax revenue was up 53 compared to March 2019 revenue including audit revenue and the additional recreational marijuana sales tax.

What is the sales tax rate in Boulder Colorado. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. 2055 lower than the maximum sales tax in CO.

The current total local sales tax rate in Boulder County CO is 4985. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs. Determining the increase in base revenue can be.

The current total local sales tax rate in Boulder CO is 4985. How to Apply for a Sales and Use Tax License. The 2020 Boulder County sales and use tax rate is 0985.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Boulder CO Sales Tax Rate. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

1398000 tax revenue divided by 100000000 assessed value 13980 Tax Rate or 1398 Mills Mill Levy The county tax rate is 1398 in revenue needed for each 1000 of assessed. Sales and Use Tax Year to date YTD sales and use tax based upon current economic. As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Corporate Income Tax Colorado General Assembly

Sales And Use Tax City Of Boulder

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

Vape E Cig Tax By State For 2022 Current Rates In Your State

Nevada Sales Tax Guide For Businesses

Colorado Sales Tax Rates By City County 2022

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax By County Webp Wikimedia Commons

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

File Sales Tax Online Department Of Revenue Taxation

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County